India has offered a silver lining to producers in what has otherwise been a cloudy week. National Fertilizers Limited today announced the widely trailed tender for shipments to 29 February. The inquiry will close on 4 January.

Indeed, with Latin American demand disappointing and offseason import inquiry light in both the USA and Europe, as well as across eastern markets, cfr values of late have been at best stable. In many markets, offers eased prior to news of India emerging.

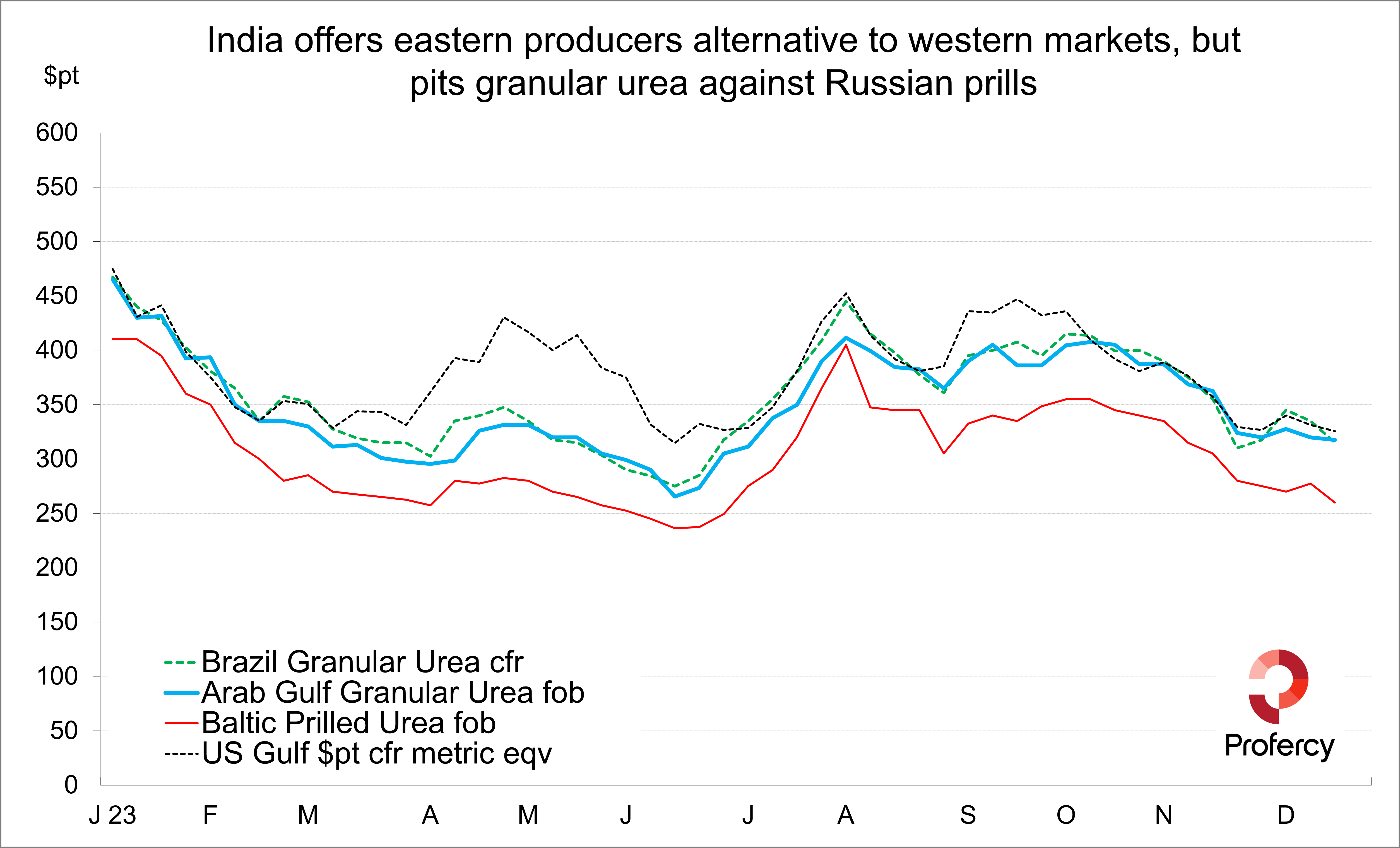

In the west, Brazilian demand has been impacted by poor weather conditions. Those with vessels on the water have been forced to quote lower with business concluded down to $310-315pt cfr. Central American inquiry has unsurprisingly been dominated by Russian suppliers, while demand elsewhere has been light.

Turkey has been active, but tenders requiring prompt shipment saw business concluded down to $340pt cfr duty paid, down $10-15pt week on week, for tonnes ex-Black Sea. Inquiries for deferred shipment into January saw sales at comparable levels, seemingly without backing.

Demand for European shipments has largely been confined to small volumes, or traders looking to cover earlier sales. This has facilitated business in Egypt in the $330s pt fob up to $340pt fob. Producers, many of whom have January tonnes to place, are hopeful improved European demand will support prices into 2024. Yet, overall nitrogen demand on the continent has been poor and has led to further nitrogen production curtailments in recent days. This despite softer gas feedstock values.

The US market continues to be a beacon of optimism with nearby values generally supported at $300ps ton fob Nola or above and February business taking place $10-15ps ton higher. The latter reflects up to $341pt cfr, a notable premium over Brazil.

The Spring season is still some time away and many are watching the import line-up closely, as well as for any signs that corn acreage estimates will improve.

India is likely to define market values into January. The latest tender is set to see considerable producer interest, particularly from prilled urea producers in Russia, as well as Middle East and SE Asian suppliers. Egyptian prilled urea could also be offered. One positive for suppliers is that China is showing little export interest.

There is some debate as to the volumes sought in what is perceived to be a restocking tender. Estimates range from 1-1.5m. tonnes, although volumes booked will likely be dictated by prices. With few markets keen on prills, it will ultimately be the volume of granular placed that will influence trade balances, particularly in the West.

Source: Profercy Nitrogen Service