Source: Profercy Nitrogen Service

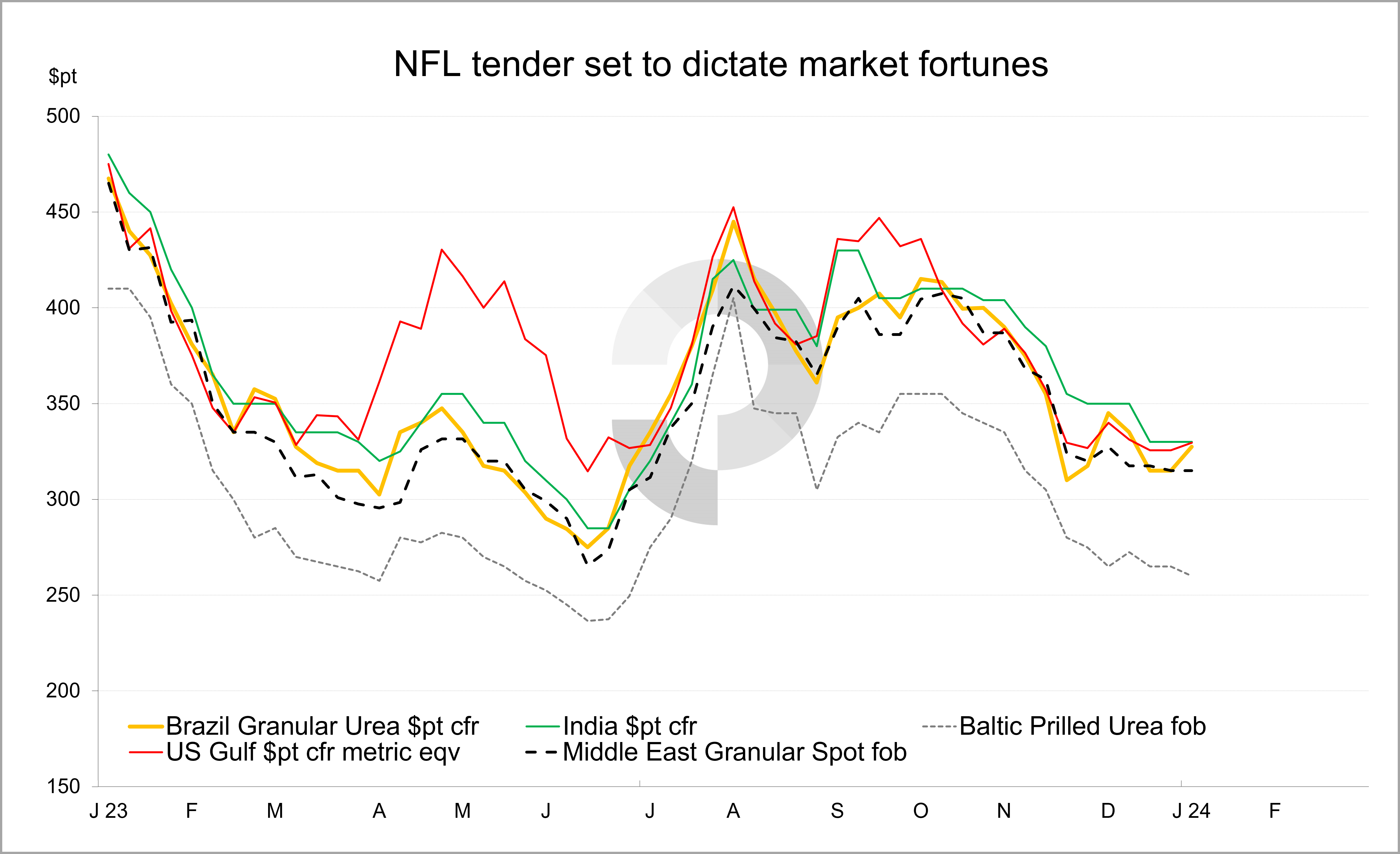

National Fertilizers Limited (NFL) closed a tender 4 January for shipments to 29 February. Business elsewhere has largely been on hold ahead of the conclusion of the tender. Indeed, both price levels and the eventual volume booked will shape market discussions around January into February shipments. This comes as peak-season import demand is due to surface in both the USA and Europe.

Offer levels have yet to be revealed, but NFL has received 21 offers for a total of 2.7m. tonnes. The total volume offered is unsurprising given the length of the shipment window.

The majority of offers have been for the west coast with these volumes totalling 1.58m. tonnes.

As widely expected, regular suppliers of Middle East and Russian material have offered the greatest volumes into the tender. To what degree producers will back the business will of course be dependent on prices.

Middle East suppliers will no doubt weigh up possible netbacks from shipments to other markets, including the USA, where forward values currently imply returns sub-$310pt fob. The ongoing disruption in the Red Sea, a regular supply route for Middle East cargoes moving to Nola, will be a consideration.

Given high freights, few expect Russian granular urea suppliers to support Indian business. Both Europe and the US market will offer better returns. However, prilled urea struggles to find outlets for major volumes and, as a result, the opportunity to commit to India will be attractive. This assumes no major price surprises.

Participation from those normally offering basis shipment from China has understandably been less significant. China is essentially absent from the international market with producers and domestic traders focused on the local market. Further, authorities have not been supportive of export business since the end of 2023.

As with previous tenders, the volume offered will include double counting as well as several offers that will no doubt be uncompetitive.

While price information could emerge today, most expect this will come on 8 January. Prior to the tender, many producers had hoped India would offer returns of $310-315pt fob Middle East equivalent. Initial reports suggest these hopes will be dashed.

More information can be found via the Profercy Nitrogen Service.