After successive rounds of counters and the eventual move to pursue east coast tonnes, India managed to secure 433,500t of urea via the 8 July tender. Just 80,000t were booked for the west coast with the balance going east at higher netbacks.

The higher east coast counter drew healthy additional volumes from the Middle East at netbacks up to the high-$340s pt fob. The lion’s share of material committed to India will come ex-Middle East with this volume including product placed from positions and offtake cargoes.

At present, little more than two, possibly three prilled cargoes, are anticipated from the Baltic.

Market subdued despite limited avails at the producer level

The response in the market has been relatively subdued thus far. Yet, supply for July into August is not abundant and global values have barely moved.

In the east, SE Asian material is committed well into August, in part due to earlier production issues and sales for Australia and nearby markets.

Some end-July into August material is available in the Middle East with a handful of producers refraining from IPL tender business. Price indications have been in line with those for east coast India, if not higher, against little firm inquiry.

Many producers are hopeful India will come back in August, while pending tenders in Pakistan and Nepal could present outlets. Further, there has been some checking for Latin American markets, even if buyers appear coy.

As before, there is little to suggest any meaningful return by China to the international market, with doubts persisting over potential business into Q4 unless domestic inventories build and local values wane.

Egyptian energy woes persist

West of Suez, most August availability is in Algeria with producers largely open and likely to consider long-haul options with European demand slow.

Yet, the fragility of Egyptian supply was demonstrated again with two producers suffering temporary total shutdowns midweek. Operating rates in Egypt remain below normal levels, although few buyers have been concerned with EU and Turkish demand light. Latest spot business has taken place at $362-367pt fob Egypt for end-July, albeit for small lots. These values are well below earlier producer price targets of $380pt fob and above.

Nigeria is effectively out of the spot market following earlier sales and given both domestic and offtake commitments. Russian suppliers have been relaxed.

Eyes turn to Latam

Beyond the aforementioned tenders, all eyes are now on Latin America. Brazilian inquiry has been light with offers at $370pt cfr attracting no buyers and some sales concluded at lower levels. Argentina is holding back owing to potential duty changes with offers still in the mid-$380s pt cfr. Many feel Mexican demand will build, yet importers have been slow to engage.

Bar some in North Africa, producers have some time before making further moves, although contract offtakers may need to find liquidity in the coming weeks.

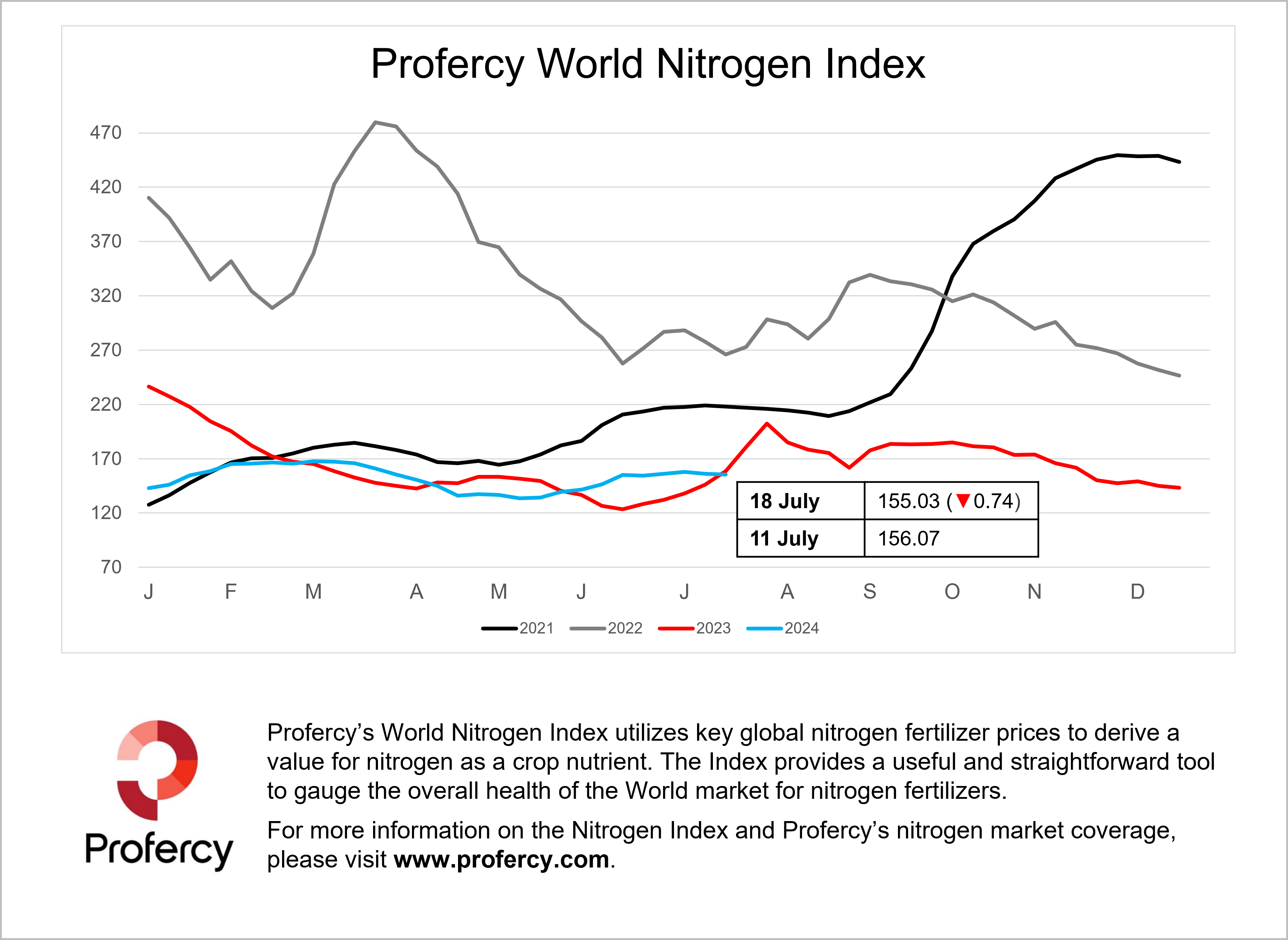

As demonstrated below, global values have been rangebound for a while. Profercy’s World Nitrogen Index registered a modest decline this week and stands at 155.03. The Index has been either side of 155 since mid-June.