Pre-Indian tender negativity has given way to newfound producer optimism in the urea market.

Business was finalised earlier this week in Rashtriya Chemicals and Fertilizers’ (RCF) import tender, with the Middle East and Russia covering almost all business. The tender saw just 560,000t lined up against a target of 800,000t for shipment by 17 July.

The global response from importers was somewhat subdued, but fob values have firmed both east and west.

Middle East producers comfortable, production issues bite in SE Asia

In the east, Chinese export restraint, alongside persistent supply challenges in SE Asia and the aforementioned RCF tender sales have limited spot July availability.

Those requiring product, including buyers in Oceania, have faced offers in the $280s pt fob Middle East with at least one cargo booked. Business has been concluded this week at least $15pt above earlier Indian tender netbacks in the mid-$260s pt fob.

Indeed, having committed 230-240,000t into India, Middle Eastern producers were quick to advance price ideas in the face of inquiries and following news that Omani product was committed for July/early-August.

Spot availability has also been limited by the extent of contract commitments priced on formula to western markets, including Brazil, where returns are well below latest spot levels.

The absence of granular urea in SE Asia has played a major role. Malaysia’s Petronas has been facing production issues on two lines, while Brunei’s BFI is absent from the market for similar reasons.

Indonesia’s Pupuk Holdings is focused on domestic stock building. This has increased the reliance of regional buyers, as well as those in Latam and Oceania, on other suppliers.

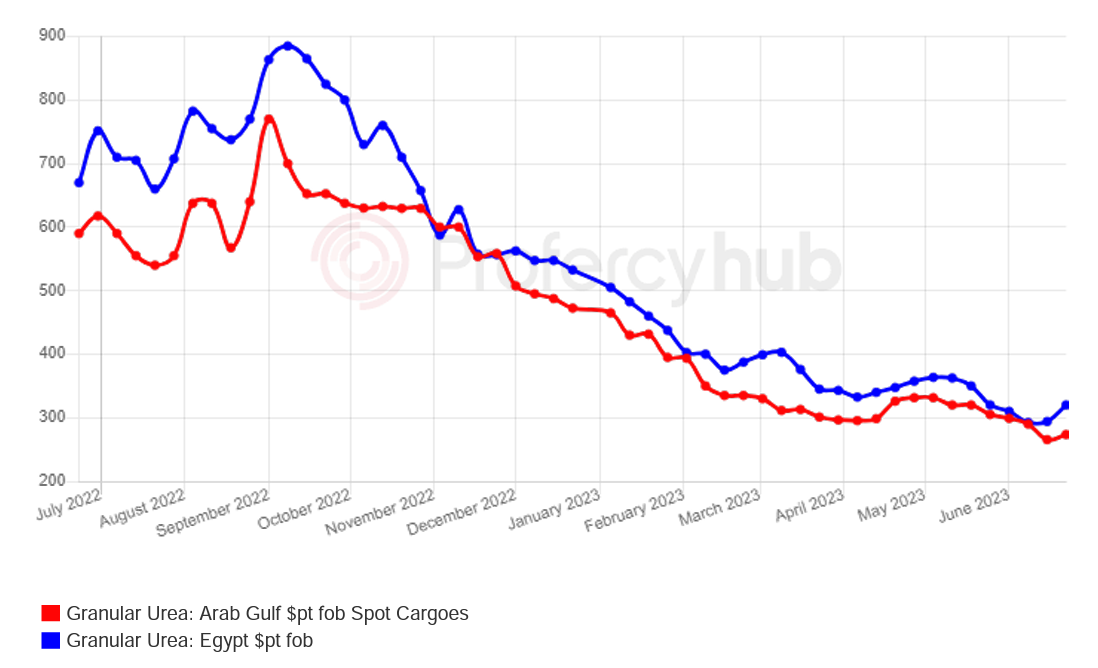

Granular urea spot values firm east and west / Source: Profercy Nitrogen

Eastern buyers turn to China

For those requiring small volumes of prills, China is an option. Prills have been sold by traders into the Philippines at competitive levels around $280pt fob.

For granular, availability has been tighter, in part due to logistics and inspection times, with last done major volume business concluded for Australia. Offers have since slipped below $300pt fob, competitive when compared to producer price ideas in the Middle East for small lots into SE Asian markets. Export commitments for July have been slim thus far.

Clearly, any signs of growing export interest, particularly for granular, could cool the global market mood.

Owing to domestic market seasonality, Chinese exports are typically greatest during the second half of the year, building from July before slowing in the winter months.

Last year, China committed 2.1m. tonnes to the market in the second half compared to just 724,000t in the first half. This at a time when export controls were in affect and producers facing far higher feedstock costs.

Export controls have since eased while coal values have been far softer, as reflected in the overall decline in Chinese domestic urea values.

North African fob values rally, despite light import business in Latam and Europe

In the west, fresh import business has been lacking, despite European buyers being faced with firmer gas values and the return of import duties.

Nevertheless, North African producers have placed major volumes in the past two weeks with the majority of sales to traders and distributors covering earlier business. Latest sales of granular have taken place up to $340pt fob with prices edging close to mid-May values.

Notably, volumes of granular urea sold this week were around 50,000t. Most July sales were concluded mid-June in the $285-300pt fob range last week with over 130,000t of business taking place.

Little fresh cfr business has been noted, even if ex-warehouse and vessel offer levels have advanced. Buyers continue to report competitive offers from Russian suppliers. Crucially, European markets are in the offseason and can delay further purchases for some time.

Opinions in the market are divided on the outlook for August shipments. Firmer gas values and stronger grain prices relative to those earlier this month have fostered confidence amongst suppliers.

However, the looming threat of greater Chinese export interest, coupled with anticipated reduced Indian import in the coming months is fostering uncertainty.

By Chris Yearsley, Director, Profercy Nitrogen

For more information on Profercy’s Nitrogen Service, please click here.