Source: Profercy Nitrogen

The urea market lived up to its reputation for turbulence and volatility this week with major price swings evident in North Africa.

At the same time, the latest purchasing tender in India reset eastern spot values with Indian Potash Limited (IPL) making light work of securing 1m. tonnes for shipment to end-December.

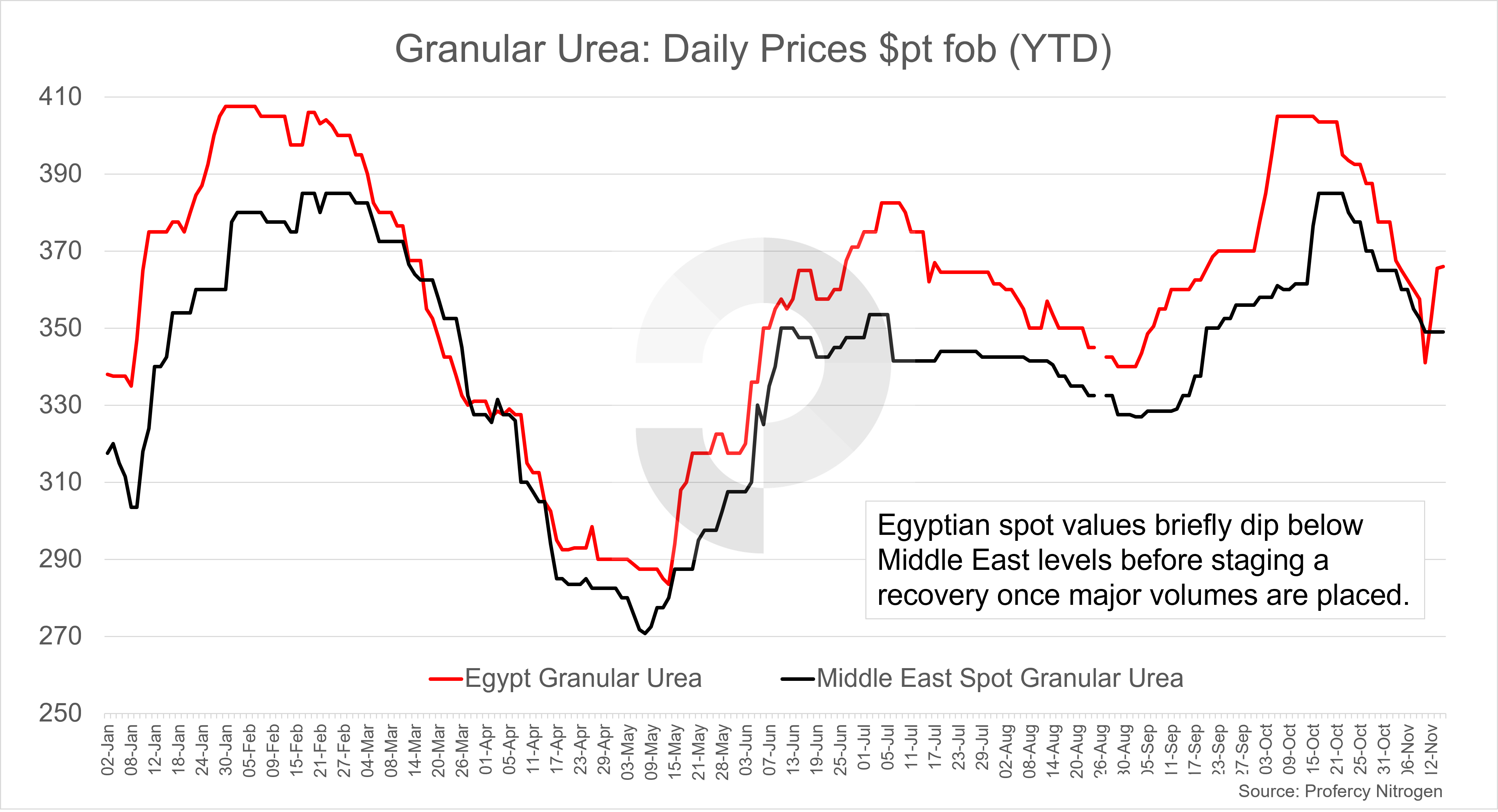

Egyptian granular values witness major price swings

Inventory build-up, light order books and improved production rates forced Egyptian producers to cut granular urea offers earlier this week before renewed interest saw prices stage a recovery.

At least 60,000t of granular urea was sold either side of $340pt fob, a figure $20pt below earlier producer price ideas and $67pt below the October peak.

As evidenced by the graph above, these values temporarily put Egyptian spot quotes at an abnormal and sharp discount to Middle East spot prices. With traders stepping to cover shorts, execute back-to-back business and take positions, a further round of business saw sales extended into the $350s pt fob before a handful of sales were concluded into the mid-$360s pt fob.

These replacement costs have yet to be accepted by buyers in Europe, but the rapid advance in regional gas costs has once again brought European nitrogen production costs into focus. Yet, a lack of farmer engagement, forex movements and logistics have kept many European distributors and importers on the sidelines.

Poor western demand aids India in securing 1m. tonnes of urea

IPL utilised two rounds of counter offers at $362pt cfr to pick up over 1m. tonnes of urea for shipment to west coast ports by 25 December in the latest inquiry. Awards in the tender have now been issued.

To secure the volume, the state agency drew close to 0.5m. tonnes from the Middle East at values reflecting either side of $350pt fob, a $10pt reduction on producer price targets last week.

Material from SE Asia and the Baltic also followed with the business signalling a reduction in spot values in those regions.

Notably, several cargoes have been lined up from Nigeria, an irregular participant in such inquiries. The slow pace of activity in Brazil, where offers were at $350pt cfr midweek, as well as sluggish demand elsewhere in Latin America, encouraged the business with netbacks from India around $330pt fob.

While recent Indian demand and the extent of sales ex-Africa have been welcomed, there is still some uncertainty as to how stable the global market is. Early-December shipments are still available in several locations, while later shipments are already on offer in the Middle East.

Western producers will be hopeful that European buyers engage soon and that Latam demand improves. Firming European gas values could force some buyers’ hands. Of note, the US also appears to be behind on imports. For those in the east, the potential for a further Indian inquiry is encouraging some optimism, even if other markets are yet to show significant interest.