Despite some nervousness in the urea market, the PWNI made more strong gains and increased by nearly 10 points week on week. The increases in urea values were not uniform as in recent weeks. However, regions that had increased at a slower rate to others (e.g. Baltic) saw the sharpest gains this week.

Baltic prilled values increased with latest business for Europe and South America taking place in the mid to high-$430s pt fob. Over the last two weeks fob values have advanced by around $45pt. While, in Algeria, a July cargo of granular urea was sold at $475pt fob, a $10pt increase from last done.

In Brazil, cfr values have rallied this week with buyers stepping back into the market and purchasing significant volumes for July shipment. Latest business from the Baltic to Brazil took place just below $500pt cfr into a major port, up from highs of $465pt cfr last week. Demand has been buoyant elsewhere in Latin America with Argentina, in particular, booking major volumes of Egyptian granular urea.

The US Gulf saw deferred values decline, with buying interest limited in the market this week owing to the depreciation in new crop corn futures. Although prompt values continue to find support, the losses further out have resulted in Brazil now overtaking the US as the premium market in the west by around $25-30pt.

The Indian purchasing tender next week will provide further clarity around market fundamentals, including the availability of exports from China, the Arab Gulf and Black Sea.

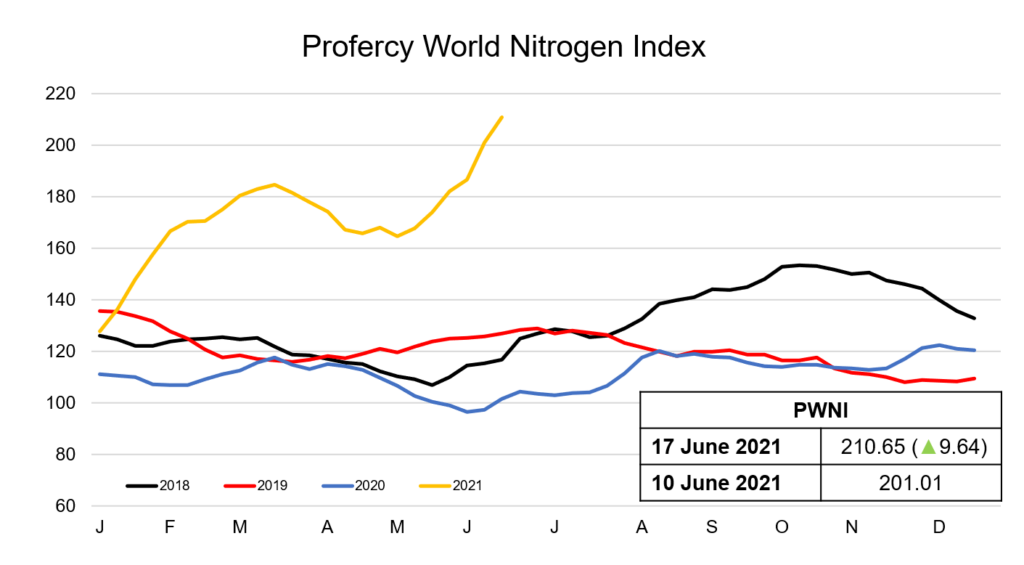

The Profercy World Nitrogen Index has raced ahead yet again this week, with prices across the nitrogen-based complex showing no sign of letting up its ascent. The Index climbed by 9.64 points this week to 210.65, remaining at levels last seen in March 2013.

By Neha Popat, Nitrogen Market Reporter