After a difficult January for nitrogen producers, global urea markets are currently on a firmer footing. Significantly, urea values in the US Gulf ran-up quickly in the last 10 days, moving up $20-30ps ton to over $245ps ton for March barges. A number of factors have supported the run-up, including the fact that the US has imported less product than last year, that upriver inventories are slim and that buyers still need to secure significant volumes for the spring season. With many international producers committed through to early-March, import levels are unlikely to build before mid-April.

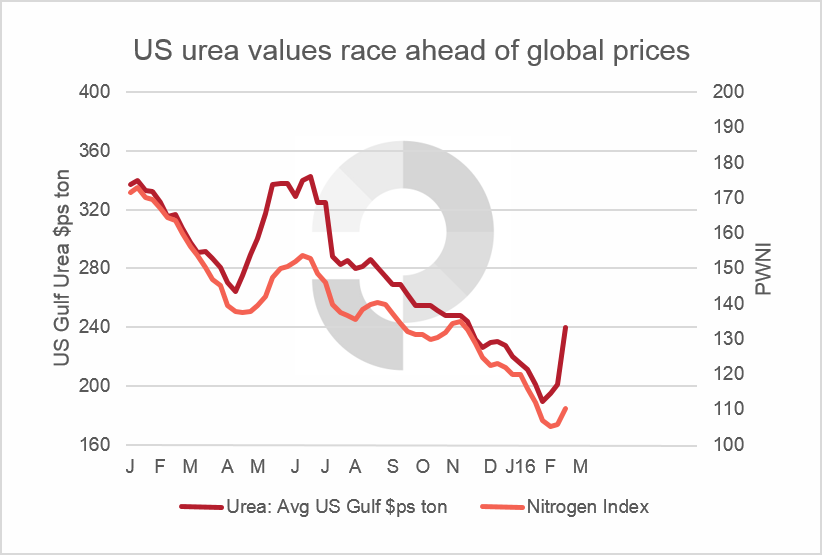

The recent run-up has afforded granular urea producers in the Arab Gulf, FSU and Latin America much higher prices than are available elsewhere. Last week’s Profercy Price Index showed that average returns for Arab Gulf product in the US were $24pt above the prevailing spot level. The difference is substantial and the increasing returns in the US have contributed to buyers in key markets, such as Brazil and Europe, raising price ideas in order to secure product in the near term. This is reflected in the graph below which shows that during peak purchasing periods in Q1 and early Q2 2015, the US market supported higher global nitrogen values.

At this stage it is hard to argue that March values in the US Gulf will slide to the lows witnessed in January, down to $180ps ton Nola. The key question for the market is whether April and May values will hold at these levels. Current Nola prices indicate that the market is tight for March, and possibly April. However, this situation can change with fresh cargoes from the Arab Gulf and China, as well as possibly North Africa, likely to add to the import line-up for end-April/May should US cfr values remain above those elsewhere. Current March prices reflect over $210pt fob China for granular product.

Ultimately though, the US market is providing a seasonal run-up in prices in a long term bear market. Once major purchasing has been concluded, market fundamentals point to a difficult Q2 for producers with market analysis expected to be concentrated on floor prices instead of price ceilings.

Free Trials of the Profercy Nitrogen Service

Profercy’s Nitrogen Service includes daily news, weekly analysis and monthly forecast reports. For more detailed information on specific products and individual markets, please sign up for a free trial or for more information on the Profercy Nitrogen Service, please click here.

Profercy World Nitrogen Index: Methodology

The Profercy World Nitrogen Index is published every week and is based on price ranges provided by the Profercy Nitrogen Service. This includes prilled and granular urea, UAN, AN, ammonium sulphate and ammonia. A full methodology can be found here.