Source: Profercy Ammonia

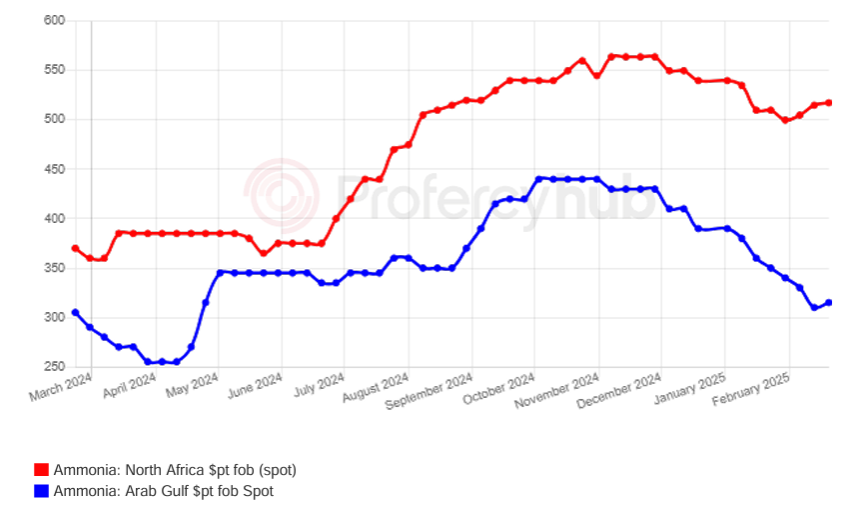

A cfr spot sale into Morocco at a significant discount to fob business in Algeria was the headline deal in yet another busy week for the international ammonia market, one in which the strong dislocation between prices in the East and West was illustrated clearly again.

Trammo’s deal with OCP Group at $459pt cfr for a 25,000t cargo for March delivery to Jorf Lasfar came shortly after a fob sale in neighbouring Algeria at $535pt fob for loading next month.

While the origin of the cargo for the phosphates major has not been shared, it will almost certainly load in the Middle East given the abundance of tonnes in that region heard available at attractive prices.

Trammo has several 25,000t capacity vessels preparing to load in the region, any of which could perform the one-month voyage to the Atlantic port around the Cape of Good Hope.

News of the heavily discounted deal emerged ahead of talks over the Tampa contract for March loadings, with that settlement always eagerly awaited, but more so at present given the large gap between fob and cfr spot prices in North Africa.

While Algerian cargoes do not move to Morocco due to political tensions, a $459pt cfr sale would feature an estimated netback of around $430-435pt fob Arzew, a range that is $100pt below most recent fob spot business out of Algeria.

Robust European import demand offers pricing support

As has been the case so far this year, plenty of spot cargoes changed hands due to the amount of surplus volume. This was particularly evident in the East, where weak industrial demand has left manufacturers in Southeast Asia with high inventories.

Until the demand situation improves both there and in India, cargoes are likely to flow West from the Arabian Gulf with increasing frequency. Around 35,000t from that region have been sold into Turkey for prompt arrival, albeit at undisclosed prices.

Demand in the West is focused on Northwest Europe, with several deals struck amid regional capacity curtailments triggered by persistently high feedstock costs.

In addition, elevated nitrates prices mean producers’ appetite for offshore ammonia shows no sign of easing, with one trader’s vessels bouncing between ports in the UK and the Netherlands on a regular basis this month.

Apart from the imminent Tampa settlement, pricing direction in the West will be dictated by the next batch of spot deals into Northwest Europe.

In the East, a seasonal pick up in orders from Indian buyers should emerge next month to help soak up some excess tonnes from the Middle East and Southeast Asia, but bar plant turnarounds or unplanned production shutdowns, that region looks long for the foreseeable future.

By Richard Ewing, Head of Ammonia/Deputy Editor at Profercy