Source: Profercy Nitrogen

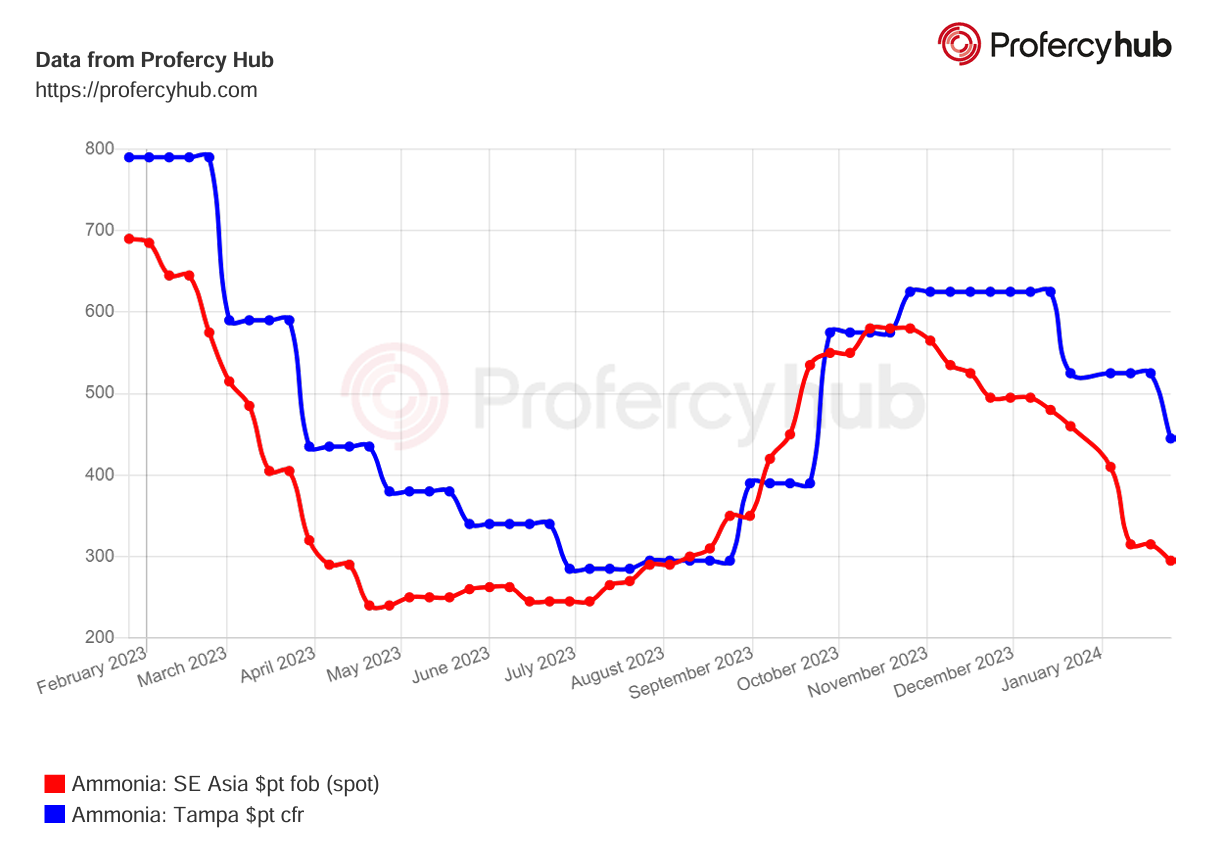

The global merchant ammonia market is longer than it has been for many months and while this week’s sharp fall in the Tampa contract was widely expected, the size of the discount slightly underwhelmed some leading players.

Many had expected a three-digit drop from January’s $525pt cfr rather than the $80pt slide to $445pt cfr given the lack of demand in key import regions, strong supply and softening of natgas prices in Europe that make locally produced ammonia more competitively priced than imports.

Significant disruption to Middle East shipments to the West was cited as one reason the US benchmark may have not moved as much as some had forecast, with some major suppliers struggling to juggle loadings and term deliveries.

The closure of the key trade corridor has played havoc with shipments, forcing delays to discharges and to loadings, as well as higher freight costs for cargoes that are sourced from the Middle East for Morocco and Europe.

The fall-out from the unprecedented logistics situation includes urgent spot deals, swap cargoes and voyage charters between suppliers in order to minimise costs.

In a relatively busy week, several spot cargoes changed hands, with most of the deals involving Trammo, including a fresh sale to OCP at an $80pt month-on-month discount to last business between the pair.

Bulgaria’s Agropolychim satisfied its urgent appetite for material with a purchase sourced in Turkey. The next cargo for Varna will be from Ma’aden, but the manufacturer is keeping everyone guessing as to its origin and supplier.

Indeed, questions are also being asked over the status of several vessels in the Mediterranean, some of which are loaded and some empty that have yet to head to Algeria.

East of Suez, plant shutdowns in Oman have removed export availability for a few weeks, while the Saudi majors are focused on contract deliveries.

Indonesia’s Kaltim failed to sell a 25,000t cargo via sales tender and will not seek to offload it through a direct sale, but Malaysia’s Petronas did offload a pair of 15,000t cargoes for prompt loading at Kerteh, albeit priced under formula.

Demand from India and Northeast Asia is subdued, and buyers have been emboldened by the scale of the market length to seek aggressive discounts.

By Richard Ewing, Head of Ammonia/Deputy News Editor at Profercy